Madison Investment and Insurance Committee Update 24 September 2020

By Andrea Theouli

For Madison adviser use only

The following is a summary of the discussion at the monthly Madison Investment and Insurance committee meeting held on 17 September 2020.

Equity markets

August 31st saw the end of reporting season. Market participants were anticipating a lot of bad news, but it did not appear to be as dire as everyone was expecting. What we can observe is that earnings per share (EPS) fell about 20% for FY20. Analysts may be a little optimistic with an expectation of 5% growth for FY21. This is largely driven by resources, healthcare, and international facing industrials.

The ASX200 accumulation index returned 2.8% in August lagging global markets. The MSCI World was up 6.3% and the S&P500 was up 7.3% for August. In Australia, technology was up 15.5%, consumer discretionary was up 8.7% and AREITS had a strong month to be up near 8% after a relatively difficult period. Conversely, utilities and communication services were both down for the month.

Macroeconomic environment – insights from external research experts

The current rally is still only sector-specific i.e., not a broad-based recovery. Financials continue to be flat. The economic impacts of COVID-19 second waves include:

- Adjusted forecasts – the downturn has not been as bad as anticipated, but the recovery will take longer.

- The stimulus will start to be unwound.

- Inflation will continue to be subdued. Negative rates are not likely however further liquidity support may be required.

The RBA growth outlook:

- The depth of the downturn was not as bad as expected, but recovery into 2021 will be weaker than previously estimated (approx. 2% growth).

- The unemployment rate is expected to increase over the rest of 2020 peaking at 10% (previously 9%) before easing to 8.5% to the end of 2021 (previously 7.5%).

- Inflation will be weaker (1% rather than 1.25%) and will likely stay in the 1% – 1.5% range for a few years.

Bond yields have stabilised in line with rock-bottom cash rates and Central Banks buying in the open market. This will likely last for quite some time. Financial repression will limit any rise in yields. Any sustained stimulus is most definitely going to have an impact on inflation contrary to what Modern Monetary Theory says.

Businesses are becoming more innovative and adaptive. This will potentially lead to a reduced need to hire staff which will likely mean a reduction in the cost to serve. Some of the changes being adopted are more structural changes which is perhaps why we have seen some of the technology stocks valuations running far ahead of their earnings as they benefit from these. Unemployment will likely struggle as a result.

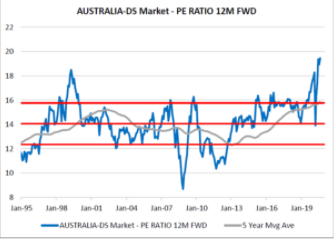

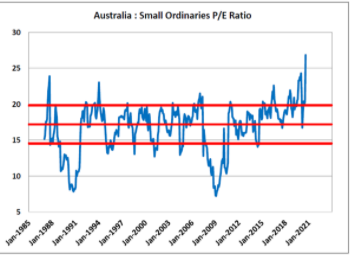

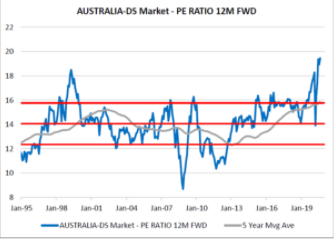

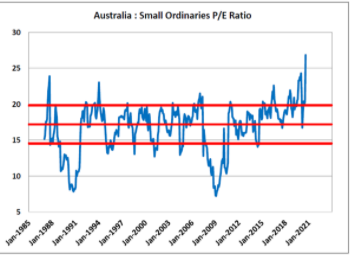

Graphs 1 and 2 show that Price to Earnings (P/E) ratios are at historic highs for both large and small-cap stocks. The fundamentals do not line up with the valuations. Interestingly there is a significant divergence between styles and P/E values. Value P/Es are sitting around 17x and growth P/Es have jumped up to around 29x. This dislocation may mean we could see a rotation across the market going forward.

Graph 1

Graph 2

AUS/USD

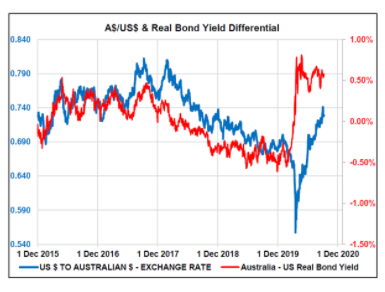

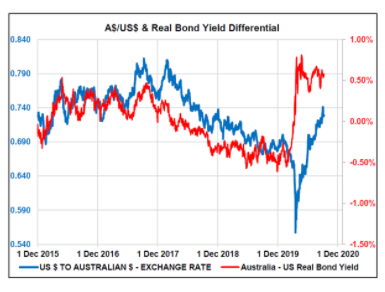

In recent weeks the AUD/USD has picked up even as Australian – U.S. bond differentials have moved sideways (shown in graph 3 below). The higher iron ore price has been a factor behind this. Futures markets are pricing a steady decline in the iron ore price to around US$92 by the end of 2021. This indicates that there will be tension between the impact of yields and iron ore on the value of the Australian dollar.

Graph 3

Gold

Gold’s rally has taken it beyond what is implied by U.S. real yields. The current retracement is following the path of new COVID-19 cases in the U.S.

More COVID cases = Gold price increases, and less COVID cases = Gold price drops.

U.S. election

Trump offers more of the same, while the Democrats offer significant change, not all of that would be kind to equity markets or the U.S.$. In August Bank of America indicators were showing that there was a 25% chance of Trump being re-re-elected. September data is showing that number jumping to 42%. This is a crucial election. If the Democrats win it will likely usher in major changes to the political and social landscape in the U.S.

Madison portfolio update

Listed security portfolios

The Australian equity portion of the portfolios has been reviewed by the Clime equities team.

The Clime equity teams approach is to look for quality/growth type companies at a reasonable price. They look for high-quality companies that can stand up in downturns by employing a quality scoring system which looks at:

- Profitability

- Margin

- Balance sheet strength

Two stocks were identified for initial review:

Tabcorp Holdings Limited (TAH) – TAH recently did a capital raise which restored some resilience. There are two divisions of this company:

- Wagering – competitive intensity has escalated, and profitability has been impacted.

- Lotteries – the most resilient market segment in Australia. The jewel in the crown of TAH.

A potential alternative would be the ASX listed company Jumbo which is a pure online lotteries business that does not have the pulldown of a wagering division.

Telstra (TLS) – Technology is getting way from Telstra. Optus and TPG have merged meaning there is one less competitor however consumer hesitancy with renewing or upgrading hardware is an issue.

Managed fund portfolios

The portfolios continue to be slightly defensively positioned. If the current retracement in equity markets persists, we may well have the opportunity to establish the equity exposures we are looking for. This may involve some greater activity in the portfolios in the short run as we position the portfolios for the medium term.

We have seen good results across the equity spectrum with both global and domestic equity exposures along with fixed-income investments contributing to the positive outcome for August. Key points to consider include:

AB Managed Volatility fund has seen slightly weak performance over the most recent 3-4 months as markets have rallied. This is not surprising given it is a low beta portfolio. The fund’s relative performance during February and March of this year provided insulation during the peak of the downturn.

IML Australian Share fund has been struggling and has not met our expectations more recently. The fund has a value bias and has consistently been underperforming. When you look at the portfolio constituents you can understand why. Given the value bias, their underweight position to the technology and healthcare sectors, which have had strong performance, has hurt their relative performance. There is no immediate call to remove from the portfolios at this point, mainly because it is not the right time in the cycle to do so however the fund is on watch.

Antipodes Global fund unsurprisingly as a value manager we see the fund struggling. The fund holds long and short positions with net exposure currently sitting at around 65% causing their performance to lag particularly as markets recovered over the last 4-5 months. Pleasingly this exposure did provide some downside protection during the volatility in February and March. We will keep watching this fund as some of their top holdings include Microsoft, Facebook, and Alibaba. Given the strong valuations of those companies, it does raise some questions as to whether there is some potential style creep as a way to try minimise underperformance.

Magellan Global fund this fund has a growth at a reasonable price (GARP) focus whilst utilising top-down macro analysis. The cash holding has come down 13% (was 15% in June, 17% in March/April) showing that they are gradually starting to redeploy some of that capital. Given the high cash level, it is unsurprising that they have lagged the benchmark slightly. Hamish Douglas does not have any concerns around geopolitical issues or its Chinese holdings including Alibaba and Tencent. The domestic market in China is strong enough to support continued earnings growth from those companies.

State Street has not performed as expected and is currently on watch. This is a quantitative strategy with an explicit focus on risk management. We would expect this fund to provide downside protection in volatile markets which was not achieved earlier this year. Potential alternatives are being considered.

DDH Preferred Income fund is doing well with a yield to maturity of 4.55%. We are keeping a close eye on the non-investment grade part of the portfolio which may come under pressure as government stimulus is lifted.

Pinebridge Global Dynamic Asset Allocation fund. The alternatives/global macro sector is struggling across the board. It is becoming more difficult to find good qualify fund managers in this alternative space that have a good track record.

AMP Capital Core Infrastructure fund there are not many alternatives that provide the unlisted exposure that reduces the volatility of returns like this fund does. We are in constant contact with John Julian (PM) to see how the portfolio is going. Inflows into the fund continue to be positive.

Our focus is to ensure that the portfolios are positioned suitably in this climate. As can be expected leading healthcare, resources and select technology companies have shown resilience. We will continue to monitor the U.S. election and how a change in Presidency may impact global markets.

Determining the most appropriate entry strategy

We will likely continue to see supportive rates and bond yields. This indicates that returns on cash, cash equivalents, and fixed income investments will exhibit low levels of return for an extended period. Entering the market now can be appropriate, but not all in one go. Dollar-cost averaging over 3, 6, 9 month periods given the current environment is prudent. For clients interested in SMAs, a similarly pragmatic approach is suggested.

APL Update

Following the Madison Investment and Insurance Committee meeting held last week the following products were approved for addition to the APL:

| Name | Identifying code |

| Franklin Absolute Return Bond Fund | FRT0027AU |

See below to access the Product Disclosure Statement and research reports specific to the above:

More from this Edition

Madison Investment and Insurance Committee Update 24 September 2020

By Andrea Theouli

For Madison adviser use only

The following is a summary of the discussion at the monthly Madison Investment and Insurance committee meeting held on 17 September 2020.

Equity markets

August 31st saw the end of reporting season. Market participants were anticipating a lot of bad news, but it did not appear to be as dire as everyone was expecting. What we can observe is that earnings per share (EPS) fell about 20% for FY20. Analysts may be a little optimistic with an expectation of 5% growth for FY21. This is largely driven by resources, healthcare, and international facing industrials.

The ASX200 accumulation index returned 2.8% in August lagging global markets. The MSCI World was up 6.3% and the S&P500 was up 7.3% for August. In Australia, technology was up 15.5%, consumer discretionary was up 8.7% and AREITS had a strong month to be up near 8% after a relatively difficult period. Conversely, utilities and communication services were both down for the month.

Macroeconomic environment – insights from external research experts

The current rally is still only sector-specific i.e., not a broad-based recovery. Financials continue to be flat. The economic impacts of COVID-19 second waves include:

- Adjusted forecasts – the downturn has not been as bad as anticipated, but the recovery will take longer.

- The stimulus will start to be unwound.

- Inflation will continue to be subdued. Negative rates are not likely however further liquidity support may be required.

The RBA growth outlook:

- The depth of the downturn was not as bad as expected, but recovery into 2021 will be weaker than previously estimated (approx. 2% growth).

- The unemployment rate is expected to increase over the rest of 2020 peaking at 10% (previously 9%) before easing to 8.5% to the end of 2021 (previously 7.5%).

- Inflation will be weaker (1% rather than 1.25%) and will likely stay in the 1% – 1.5% range for a few years.

Bond yields have stabilised in line with rock-bottom cash rates and Central Banks buying in the open market. This will likely last for quite some time. Financial repression will limit any rise in yields. Any sustained stimulus is most definitely going to have an impact on inflation contrary to what Modern Monetary Theory says.

Businesses are becoming more innovative and adaptive. This will potentially lead to a reduced need to hire staff which will likely mean a reduction in the cost to serve. Some of the changes being adopted are more structural changes which is perhaps why we have seen some of the technology stocks valuations running far ahead of their earnings as they benefit from these. Unemployment will likely struggle as a result.

Graphs 1 and 2 show that Price to Earnings (P/E) ratios are at historic highs for both large and small-cap stocks. The fundamentals do not line up with the valuations. Interestingly there is a significant divergence between styles and P/E values. Value P/Es are sitting around 17x and growth P/Es have jumped up to around 29x. This dislocation may mean we could see a rotation across the market going forward.

Graph 1

Graph 2

AUS/USD

In recent weeks the AUD/USD has picked up even as Australian – U.S. bond differentials have moved sideways (shown in graph 3 below). The higher iron ore price has been a factor behind this. Futures markets are pricing a steady decline in the iron ore price to around US$92 by the end of 2021. This indicates that there will be tension between the impact of yields and iron ore on the value of the Australian dollar.

Graph 3

Gold

Gold’s rally has taken it beyond what is implied by U.S. real yields. The current retracement is following the path of new COVID-19 cases in the U.S.

More COVID cases = Gold price increases, and less COVID cases = Gold price drops.

U.S. election

Trump offers more of the same, while the Democrats offer significant change, not all of that would be kind to equity markets or the U.S.$. In August Bank of America indicators were showing that there was a 25% chance of Trump being re-re-elected. September data is showing that number jumping to 42%. This is a crucial election. If the Democrats win it will likely usher in major changes to the political and social landscape in the U.S.

Madison portfolio update

Listed security portfolios

The Australian equity portion of the portfolios has been reviewed by the Clime equities team.

The Clime equity teams approach is to look for quality/growth type companies at a reasonable price. They look for high-quality companies that can stand up in downturns by employing a quality scoring system which looks at:

- Profitability

- Margin

- Balance sheet strength

Two stocks were identified for initial review:

Tabcorp Holdings Limited (TAH) – TAH recently did a capital raise which restored some resilience. There are two divisions of this company:

- Wagering – competitive intensity has escalated, and profitability has been impacted.

- Lotteries – the most resilient market segment in Australia. The jewel in the crown of TAH.

A potential alternative would be the ASX listed company Jumbo which is a pure online lotteries business that does not have the pulldown of a wagering division.

Telstra (TLS) – Technology is getting way from Telstra. Optus and TPG have merged meaning there is one less competitor however consumer hesitancy with renewing or upgrading hardware is an issue.

Managed fund portfolios

The portfolios continue to be slightly defensively positioned. If the current retracement in equity markets persists, we may well have the opportunity to establish the equity exposures we are looking for. This may involve some greater activity in the portfolios in the short run as we position the portfolios for the medium term.

We have seen good results across the equity spectrum with both global and domestic equity exposures along with fixed-income investments contributing to the positive outcome for August. Key points to consider include:

AB Managed Volatility fund has seen slightly weak performance over the most recent 3-4 months as markets have rallied. This is not surprising given it is a low beta portfolio. The fund’s relative performance during February and March of this year provided insulation during the peak of the downturn.

IML Australian Share fund has been struggling and has not met our expectations more recently. The fund has a value bias and has consistently been underperforming. When you look at the portfolio constituents you can understand why. Given the value bias, their underweight position to the technology and healthcare sectors, which have had strong performance, has hurt their relative performance. There is no immediate call to remove from the portfolios at this point, mainly because it is not the right time in the cycle to do so however the fund is on watch.

Antipodes Global fund unsurprisingly as a value manager we see the fund struggling. The fund holds long and short positions with net exposure currently sitting at around 65% causing their performance to lag particularly as markets recovered over the last 4-5 months. Pleasingly this exposure did provide some downside protection during the volatility in February and March. We will keep watching this fund as some of their top holdings include Microsoft, Facebook, and Alibaba. Given the strong valuations of those companies, it does raise some questions as to whether there is some potential style creep as a way to try minimise underperformance.

Magellan Global fund this fund has a growth at a reasonable price (GARP) focus whilst utilising top-down macro analysis. The cash holding has come down 13% (was 15% in June, 17% in March/April) showing that they are gradually starting to redeploy some of that capital. Given the high cash level, it is unsurprising that they have lagged the benchmark slightly. Hamish Douglas does not have any concerns around geopolitical issues or its Chinese holdings including Alibaba and Tencent. The domestic market in China is strong enough to support continued earnings growth from those companies.

State Street has not performed as expected and is currently on watch. This is a quantitative strategy with an explicit focus on risk management. We would expect this fund to provide downside protection in volatile markets which was not achieved earlier this year. Potential alternatives are being considered.

DDH Preferred Income fund is doing well with a yield to maturity of 4.55%. We are keeping a close eye on the non-investment grade part of the portfolio which may come under pressure as government stimulus is lifted.

Pinebridge Global Dynamic Asset Allocation fund. The alternatives/global macro sector is struggling across the board. It is becoming more difficult to find good qualify fund managers in this alternative space that have a good track record.

AMP Capital Core Infrastructure fund there are not many alternatives that provide the unlisted exposure that reduces the volatility of returns like this fund does. We are in constant contact with John Julian (PM) to see how the portfolio is going. Inflows into the fund continue to be positive.

Our focus is to ensure that the portfolios are positioned suitably in this climate. As can be expected leading healthcare, resources and select technology companies have shown resilience. We will continue to monitor the U.S. election and how a change in Presidency may impact global markets.

Determining the most appropriate entry strategy

We will likely continue to see supportive rates and bond yields. This indicates that returns on cash, cash equivalents, and fixed income investments will exhibit low levels of return for an extended period. Entering the market now can be appropriate, but not all in one go. Dollar-cost averaging over 3, 6, 9 month periods given the current environment is prudent. For clients interested in SMAs, a similarly pragmatic approach is suggested.

APL Update

Following the Madison Investment and Insurance Committee meeting held last week the following products were approved for addition to the APL:

| Name | Identifying code |

| Franklin Absolute Return Bond Fund | FRT0027AU |

See below to access the Product Disclosure Statement and research reports specific to the above:

More from this Edition