Economic Update

By Andrea Theouli

The COVID-19 pandemic has had a significant impact on Australia’s health system, community, and economy. The recent strength in consumer spending, housing activity, and business conditions surveys are demonstrating the global economic recovery is in full force. Although recovery is underway, volatility in markets will remain for some time. Whilst the state governments in Australia are easing restrictions, we need to remember that the COVID-19 pandemic is not over and we should not be complacent. The resurgence of COVID-19 across Europe and elsewhere is sparking fears of a reversal in the global recovery over the (northern hemisphere) winter. While fiscal policy will continue to do much of the heavy lifting, economic uncertainty is putting renewed pressure on central banks to act indicating that more needs to be done from a policy perspective.

Key developments in September and early October 2020

The U.S. economy has responded well to its reopening with output likely expanding in the third quarter, but challenges remain. The case for more fiscal stimulus is strong, with the 3 November election critical to determining how quickly a full recovery comes. While Biden was well ahead in the polls a few months ago, the gap is much smaller now and almost non-existent in certain key swing states.

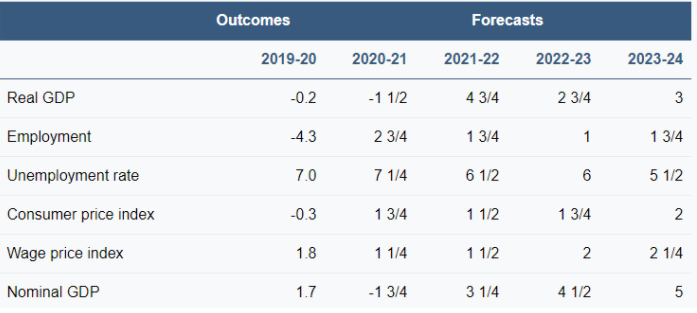

Locally, the containment of the second wave in Victoria has bolstered hopes for all lockdown measures to be steadily lifted. Economic growth in Australia in the second quarter fell by 7.0%, confirming our first recession in almost three decades. The Government has acted quickly and positively to address the consequences of COVID-19. The 2020-21 Budget affirms this by committing additional recovery support, bringing the Government’s overall support to $507 billion, including $257 billion in direct economic support[1]. Whilst we continue to navigate unchartered waters, it is evident that Australia has fared better than many other developed nations. Chart 1 below shows the outcomes and forecasts of major economic parameters.

Both Australian and U.S. unemployment rates fell markedly in their September data releases showing signs of resilience and recovery however it is far too soon to suggest that either economy is really healing.

Chart 1

Source: Australian Bureau of Statistics – Australian National Accounts

The markets

In September, international equities, as measured by the MSCI world index in Australian dollar terms, returned -0.31% while Australian equities as measured by the ASX200 returned -3.66% as a result of:

- COVID-19 cases continuing to increase;

- The impending U.S. presidential election;

- Continued U.S./China tensions; and

- The stalled U.S. fiscal stimulus.

Markets will remain vulnerable to further short-term volatility however on a 6 to 12-month view, markets are expected to see improved gains helped by a pick-up in economic activity and stimulus.

Investor considerations

If you are under 55 years old

The long-term outlook is still strong. The economic impact of COVID-19 has caused an external shock which in turn has resulted in a dislocation. The global economy was in reasonable shape heading into this pandemic and should show resilience as time passes.

If you are over 55 years old (nearing retirement)

You should consider your tolerance for investment risk as the returns during the next few years might continue to be volatile and subdued. It would be prudent to expect low inflation and low-interest rates in the short-term.

If you are already retired or on a pension

While inflation should remain low, reducing the cost of living pressures on retirees, defensive investment options may not provide a meaningful level of income over the next few years. Investment choices should be reviewed.

What now?

It is human nature to resist change, particularly when it comes in the form of adversity or challenges. Change is inevitable, and developing the trait of resilience helps us not only survive change, but also learn, grow, and thrive in it. Resilience is the capacity to cope with stress and adversity. Maintaining resilience during times of upheaval is difficult. As our economy moves through the recovery, we need to adapt. We have identified some key ways to develop your resilience as we move through the recovery:

Stay prepared

Keep planning for the future even when things aren’t working out. Do not become paralysed by negativity.

Build relationships

Maintain strong and supportive relationships, both personally and professionally. Having caring, supportive people around you in times of crisis is critical.

Create your own meaning

Develop a “personal why” that helps you have a clear sense of purpose. Pay attention to the complexities of your experiences, listen to your emotions, and be willing to learn from disappointment and failure as well as success and motivation. This will help you look at setbacks from a broader perspective.

[1] Budget 2020-21 – Budget overview

More from this Edition

Economic Update

By Andrea Theouli

The COVID-19 pandemic has had a significant impact on Australia’s health system, community, and economy. The recent strength in consumer spending, housing activity, and business conditions surveys are demonstrating the global economic recovery is in full force. Although recovery is underway, volatility in markets will remain for some time. Whilst the state governments in Australia are easing restrictions, we need to remember that the COVID-19 pandemic is not over and we should not be complacent. The resurgence of COVID-19 across Europe and elsewhere is sparking fears of a reversal in the global recovery over the (northern hemisphere) winter. While fiscal policy will continue to do much of the heavy lifting, economic uncertainty is putting renewed pressure on central banks to act indicating that more needs to be done from a policy perspective.

Key developments in September and early October 2020

The U.S. economy has responded well to its reopening with output likely expanding in the third quarter, but challenges remain. The case for more fiscal stimulus is strong, with the 3 November election critical to determining how quickly a full recovery comes. While Biden was well ahead in the polls a few months ago, the gap is much smaller now and almost non-existent in certain key swing states.

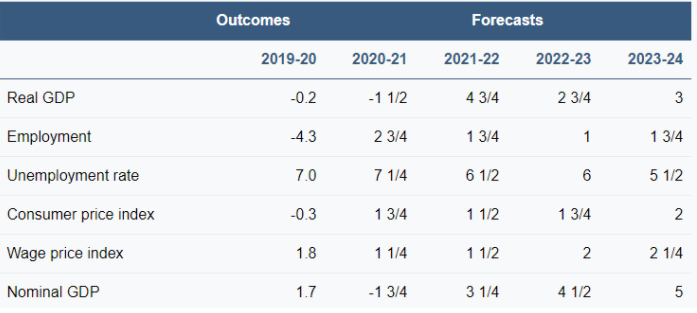

Locally, the containment of the second wave in Victoria has bolstered hopes for all lockdown measures to be steadily lifted. Economic growth in Australia in the second quarter fell by 7.0%, confirming our first recession in almost three decades. The Government has acted quickly and positively to address the consequences of COVID-19. The 2020-21 Budget affirms this by committing additional recovery support, bringing the Government’s overall support to $507 billion, including $257 billion in direct economic support[1]. Whilst we continue to navigate unchartered waters, it is evident that Australia has fared better than many other developed nations. Chart 1 below shows the outcomes and forecasts of major economic parameters.

Both Australian and U.S. unemployment rates fell markedly in their September data releases showing signs of resilience and recovery however it is far too soon to suggest that either economy is really healing.

Chart 1

Source: Australian Bureau of Statistics – Australian National Accounts

The markets

In September, international equities, as measured by the MSCI world index in Australian dollar terms, returned -0.31% while Australian equities as measured by the ASX200 returned -3.66% as a result of:

- COVID-19 cases continuing to increase;

- The impending U.S. presidential election;

- Continued U.S./China tensions; and

- The stalled U.S. fiscal stimulus.

Markets will remain vulnerable to further short-term volatility however on a 6 to 12-month view, markets are expected to see improved gains helped by a pick-up in economic activity and stimulus.

Investor considerations

If you are under 55 years old

The long-term outlook is still strong. The economic impact of COVID-19 has caused an external shock which in turn has resulted in a dislocation. The global economy was in reasonable shape heading into this pandemic and should show resilience as time passes.

If you are over 55 years old (nearing retirement)

You should consider your tolerance for investment risk as the returns during the next few years might continue to be volatile and subdued. It would be prudent to expect low inflation and low-interest rates in the short-term.

If you are already retired or on a pension

While inflation should remain low, reducing the cost of living pressures on retirees, defensive investment options may not provide a meaningful level of income over the next few years. Investment choices should be reviewed.

What now?

It is human nature to resist change, particularly when it comes in the form of adversity or challenges. Change is inevitable, and developing the trait of resilience helps us not only survive change, but also learn, grow, and thrive in it. Resilience is the capacity to cope with stress and adversity. Maintaining resilience during times of upheaval is difficult. As our economy moves through the recovery, we need to adapt. We have identified some key ways to develop your resilience as we move through the recovery:

Stay prepared

Keep planning for the future even when things aren’t working out. Do not become paralysed by negativity.

Build relationships

Maintain strong and supportive relationships, both personally and professionally. Having caring, supportive people around you in times of crisis is critical.

Create your own meaning

Develop a “personal why” that helps you have a clear sense of purpose. Pay attention to the complexities of your experiences, listen to your emotions, and be willing to learn from disappointment and failure as well as success and motivation. This will help you look at setbacks from a broader perspective.

[1] Budget 2020-21 – Budget overview