Who survived the ‘Kodak moment’?

By Andrea Theouli

Within the COVID-19 environment, businesses capable of adapting quickly to an online milieu have thrived, whereas many caught up in sectors such as bricks and mortar retailing, international travel, live entertainment have struggled. These changes have meant we have seen big winners and losers in financial markets.

According to Google the phrase ‘Kodak moment’ was immortalised in the 1980s[1] and describes ‘an occasion suitable for memorialising with a photograph[2]. When I think of a ‘Kodak moment’ I remember New Year’s Eve Y2K, the first iPhone, and the last time the AUD/USD was at parity. Ironically, Kodak itself has become a bit of a ‘Kodak moment’ with digital photography taking off in the late 1990s and Kodak not being ready for it[3].

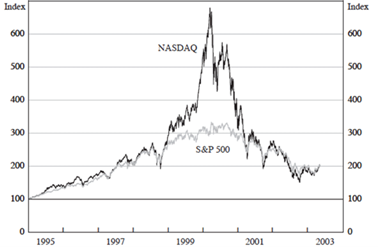

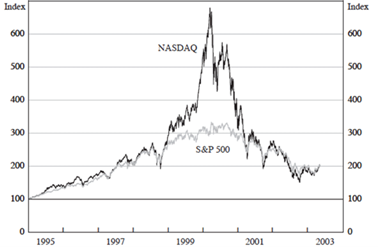

The rapid digitisation of photography can be likened to the dot-com bubble. The dot-com bubble was the result of a period of massive growth in the use and adoption of the internet which then caused excessive speculation of internet-related companies from 1995 into the early 2000s. Figure 1 suggests that the bubble started around the beginning of 1999.

Figure 1: US Share Price Indices

Source: RBA

In the lead up to the bubble bursting, the benefits of new technology were widely publicised. In Cooper, Dimitrov, and Rau’s 2001, ‘A Rose.com by Any Other Name’, it was documented that the simple addition of dot-com to a company’s name was sufficient for it to become the object of speculation. The prolonged expansion through the 1990s was seen as evidence that the business cycle had been tamed[4]. This led to many arguments stating that over the long run, shares were safer than bonds. Companies with the vaguest business plans were floated on stock exchanges at enormous premiums to their underlying capital value (i.e. they were essentially concept stocks[5]).

Locally, there was a large proportion of ASX constituents in the technology and telecommunications sectors. Telstra was around $8 and about 4-5% of the market weight. Looking back to the early 2000s we can observe that a number of the companies listed on the ASX no longer exist. One of those is OneTel which at one point was worth about $4billion then a year or two later was gone.

From a Melbourne garage to a global media conglomerate

There aren’t too many success stories born out of the dot-com era however REA Group is definitely one of them. realestate.com.au started as an idea to use the internet to alter the way people experience property. In 1995, in a garage in the eastern suburbs of Melbourne, when the internet was in its early days, Martin Howell and Karl Sabljak, REA’s founders, came up with the idea to search for property online[6]. Howell and Sabljak’s initial objective was to provide small businesses with dial-up internet services provider (ISP) services and websites. Over time, they realized that creating websites and being an ISP was a tough endeavour. They pivoted their business model and started to advertise real estate listings on a site called Virtual Realty soon after they were able to secure the realestate.com.au URL[7]. The rest is history.

It is unlikely that they would have predicted back then just how much their idea would change the way people experience property. Today, REA Group is one of the great Australian start-up success stories. Spanning eight countries and with more than 1,400 people[8]. The company now operates property websites in 10 countries that are used by more than 19,000 agents and have approximately 8.8 million unique visitors per month[9].

2020 has been a year of reflection and adaptation. Many businesses have had to pivot and change their business models just to keep the lights on and the doors open. Whilst change is inevitable, it is important to remember where we’ve come from, after all every winner was once a beginner.

[1] Google Search – What is a Kodak moment?

[2] Oxford Languages

[3] Tech Crunch – What happened to Kodak’s moment?

[4] Three Australian Asset-price Bubbles – John Simon

[5] Concept stocks: firms with extremely high levels of market to sales value.

[6] Propertynoise.com.au – REA Groups early days

[7] Property PortalWatch – A journey back in time: the birth of the REA Group

[8] REA Group – Our story

[9] January 2008, Nielsen//NetRatings, Omniture, HBX Analytics

More from this Edition

| · Note From Annick | · Investment Service Transition

· Kaplan Professional new Ontrak platform |

· Key Dates in Xplan |

Who survived the ‘Kodak moment’?

By Andrea Theouli

Within the COVID-19 environment, businesses capable of adapting quickly to an online milieu have thrived, whereas many caught up in sectors such as bricks and mortar retailing, international travel, live entertainment have struggled. These changes have meant we have seen big winners and losers in financial markets.

According to Google the phrase ‘Kodak moment’ was immortalised in the 1980s[1] and describes ‘an occasion suitable for memorialising with a photograph[2]. When I think of a ‘Kodak moment’ I remember New Year’s Eve Y2K, the first iPhone, and the last time the AUD/USD was at parity. Ironically, Kodak itself has become a bit of a ‘Kodak moment’ with digital photography taking off in the late 1990s and Kodak not being ready for it[3].

The rapid digitisation of photography can be likened to the dot-com bubble. The dot-com bubble was the result of a period of massive growth in the use and adoption of the internet which then caused excessive speculation of internet-related companies from 1995 into the early 2000s. Figure 1 suggests that the bubble started around the beginning of 1999.

Figure 1: US Share Price Indices

Source: RBA

In the lead up to the bubble bursting, the benefits of new technology were widely publicised. In Cooper, Dimitrov, and Rau’s 2001, ‘A Rose.com by Any Other Name’, it was documented that the simple addition of dot-com to a company’s name was sufficient for it to become the object of speculation. The prolonged expansion through the 1990s was seen as evidence that the business cycle had been tamed[4]. This led to many arguments stating that over the long run, shares were safer than bonds. Companies with the vaguest business plans were floated on stock exchanges at enormous premiums to their underlying capital value (i.e. they were essentially concept stocks[5]).

Locally, there was a large proportion of ASX constituents in the technology and telecommunications sectors. Telstra was around $8 and about 4-5% of the market weight. Looking back to the early 2000s we can observe that a number of the companies listed on the ASX no longer exist. One of those is OneTel which at one point was worth about $4billion then a year or two later was gone.

From a Melbourne garage to a global media conglomerate

There aren’t too many success stories born out of the dot-com era however REA Group is definitely one of them. realestate.com.au started as an idea to use the internet to alter the way people experience property. In 1995, in a garage in the eastern suburbs of Melbourne, when the internet was in its early days, Martin Howell and Karl Sabljak, REA’s founders, came up with the idea to search for property online[6]. Howell and Sabljak’s initial objective was to provide small businesses with dial-up internet services provider (ISP) services and websites. Over time, they realized that creating websites and being an ISP was a tough endeavour. They pivoted their business model and started to advertise real estate listings on a site called Virtual Realty soon after they were able to secure the realestate.com.au URL[7]. The rest is history.

It is unlikely that they would have predicted back then just how much their idea would change the way people experience property. Today, REA Group is one of the great Australian start-up success stories. Spanning eight countries and with more than 1,400 people[8]. The company now operates property websites in 10 countries that are used by more than 19,000 agents and have approximately 8.8 million unique visitors per month[9].

2020 has been a year of reflection and adaptation. Many businesses have had to pivot and change their business models just to keep the lights on and the doors open. Whilst change is inevitable, it is important to remember where we’ve come from, after all every winner was once a beginner.

[1] Google Search – What is a Kodak moment?

[2] Oxford Languages

[3] Tech Crunch – What happened to Kodak’s moment?

[4] Three Australian Asset-price Bubbles – John Simon

[5] Concept stocks: firms with extremely high levels of market to sales value.

[6] Propertynoise.com.au – REA Groups early days

[7] Property PortalWatch – A journey back in time: the birth of the REA Group

[8] REA Group – Our story

[9] January 2008, Nielsen//NetRatings, Omniture, HBX Analytics

More from this Edition

| · Note From Annick | · Investment Service Transition

· Kaplan Professional new Ontrak platform |

· Key Dates in Xplan |